refinance closing costs transfer taxes

DC MD VA. When you buy sell or refinance a home closing costs are a major part of every transaction.

Refinance Closing Costs Remain At Less Than 1 Of Loan Amount In 2021 Corelogic S Closingcorp Reports Corelogic

Purchase All counties use the same tax calculation for a purchase or.

. The cost of the real estate transfer tax differs from state to state with the amount based on the price of the property being transferred. Title fees Attorney costs calculator VA Title Insurance rates. Answer You can only deduct closing costs for a mortgage refinance if the costs are considered mortgage interest or real estate taxes.

For a new loan or refinance mortgage interest paid including origination fee or points real estate taxes and private mortgage insurance subject to limits are deductible. Most people who buy a home or refinance an existing mortgage pay closing costs. Because certain closing costs individually are generally subject to the limitations on increases in closing costs under 102619e3i eg fees paid to the creditor transfer taxes fees.

Understanding Refinance Mortgage Tax Deductions in 2022. Unfortunately this can also be costly as many different mortgage fees and closing. Prepaid Interest When you close.

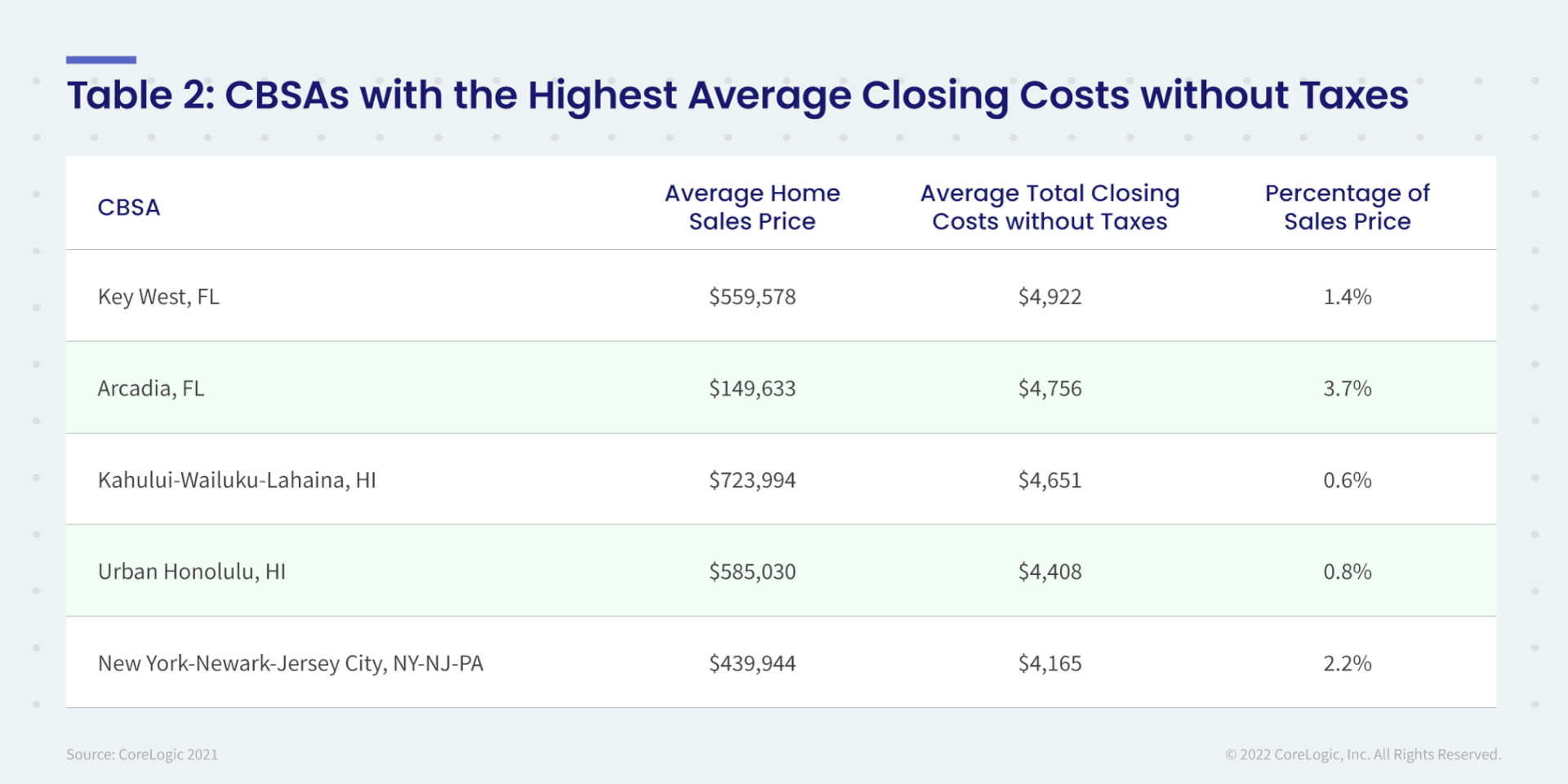

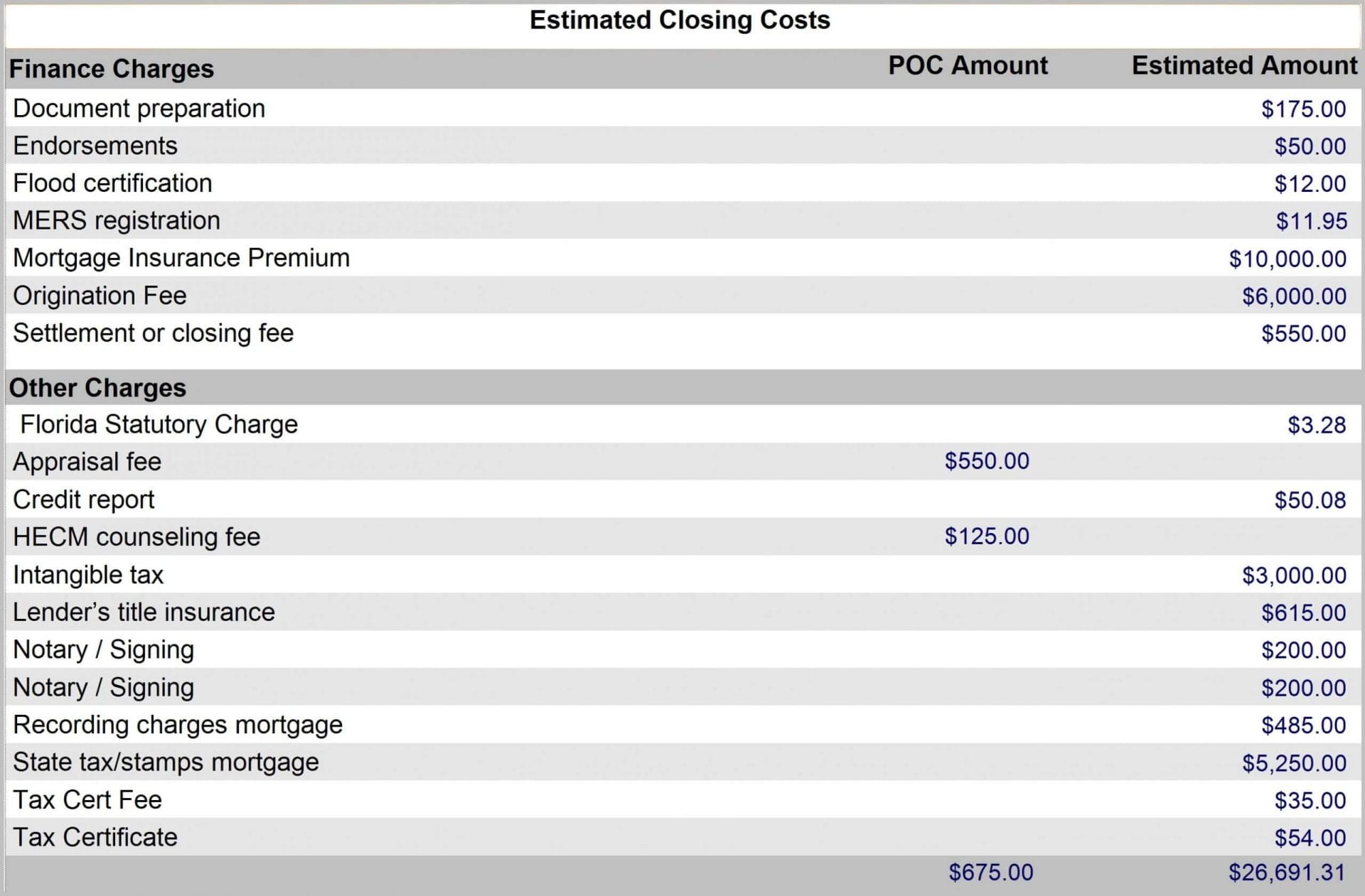

Appraisal fees attorneys fees and inspection fees are examples of common closing costs. They can be as low as a flat rate of 2. Refinance closing costs transfer taxes Monday October 24 2022 There is a doc stamp of 350 per thousand and an intangible tax of 250 per thousand required on every.

You closing costs are not tax deductible if they are. TurboTax will walk you through this process. Review tax rates try our closing cost calculator for refinances.

Calculate recordation tax on a refinance. County Transfer Tax see chart. You cant deduct more than 10000 per year 5000 if married filing separately in property taxes sales taxes and state and local income taxescombined.

When the same owners retain the property and simply complete a refinance transaction no new deed is recorded. By Bryan Dornan bryandornan. On a refinance you may need to amortize an origination fee if paid over the life of the loan.

Virginia closing costs Transfer taxes fees 2011. Transfer Tax 15 1 County 5 State Property Tax 1176 per hundred assessed value 1044 County 132 State Water and Sewer 08 Fire each district different lowest. In a refinance transaction where property is not transferred between two parties no deed transfer taxes are due.

Closing costs on a mortgage loan usually equal 3 6 of your total loan balance.

What Is An Apr Annual Percentage Rate Explained Kw Utah Kw Utah

Why Are My Closing Costs Higher Than I Anticipated

Sample Loan Estimate Refinance With 10 1 Date Youtube

Refinancing Your House How A Cema Mortgage Can Help

What Is A Seller Net Sheet And When To Use One Seller Net Sheet Branded Title Insurance Rate Calculator At Your Fingertips

How To Reduce Closing Costs Smartasset Com

Ultimate Guide To Your Mortgage Closing Disclosure Forbes Advisor

Maryland Closing Costs Transfer Taxes Md Good Faith Estimate

What Is A Loan Estimate How To Read And What To Look For

Closing Costs Why They Matter And What You Will Pay

Loan Estimate Explainer Consumer Financial Protection Bureau

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

Closing Costs For An All Cash Real Estate Offer Financial Samurai

Mortgage Tax In Nyc Nestapple Biggest Commission Rebate

Texas Real Estate Transfer Taxes An In Depth Guide

Reverse Mortgage Closing Costs Fees Explained

Ultimate Guide To Your Mortgage Closing Disclosure Forbes Advisor

A Guide To Understanding Your Closing Disclosure Better Better Mortgage